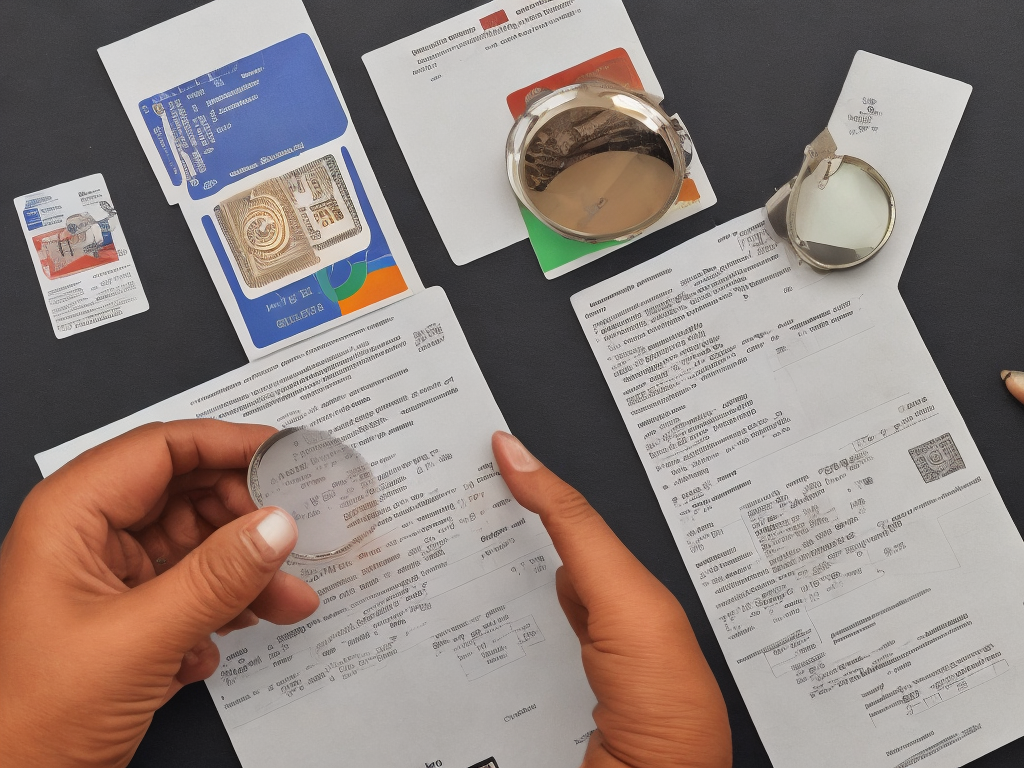

In India, it is mandatory to link your Pan Card with your Aadhaar card. This is a step taken by the government to ensure transparency and prevent tax evasion. Pan Card is used to track an individual’s financial transactions while Aadhaar card identifies a person uniquely. According to the Income Tax Department, the last date for linking a Pan Card with Aadhaar is 31st March 2021. In case you haven’t linked your Pan Card with Aadhaar yet, follow these simple steps to do so:

Step 1: Visit the Income Tax e-filing website

Visit the official website of the Income Tax Department of India. The link for the website is https://www.incometaxindiaefiling.gov.in/home

Step 2: Enter your login Id and password

If you have already registered on the website, then enter your login credentials. If you haven’t registered then you can register yourself by selecting the ‘Register Yourself’ option.

Step 3: Click on ‘Link Aadhaar’

On the left side of the page, you can see different options. Under the Profile Settings option, click on ‘Link Aadhaar’

Step 4: Enter your details

A window will pop-up asking for your details. Enter your Pan Card number, Aadhaar number, name as per Aadhaar and submit the form.

Step 5: Check the status of Pan-Aadhaar linking

After submitting the form, you can check the status of your Pan-Aadhaar linking. To check the status, go to the ‘Profile Settings’ option and click on ‘Link Aadhaar status’.

In case your Pan Card and Aadhaar are already linked, the website will display a message that your PAN is linked to Aadhaar. If it isn’t linked, the website will direct you to link them.

Besides the e-filing website of the Income Tax Department, there are other ways to link your Pan Card with Aadhaar.

1. Through SMS

You can link your Pan Card with Aadhaar by sending an SMS to 567678 or 56161. Type UIDPAN<12-digit Aadhaar number> <10-digit Pan Card number> and send it.

2. Through post

You can also link your Pan Card with Aadhaar by sending a letter to the Income Tax Department. The letter should be addressed to the Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th floor, Mantri Sterling, Plot No.341, Survey No.997/8, Model Colony, Near Deep Bungalow Chowk, Pune - 411016. Mention your Pan Card number, Aadhaar number, and a copy of both.

3. Through Mobile application

You can link your Pan Card with Aadhaar using the mobile application of the Income Tax Department called the ‘Aaykar Setu’ app.

In conclusion, it is important to link your Pan Card with Aadhaar to avoid any legal complications. There are multiple ways to link your PAN with Aadhaar. One can easily check the status of Pan-Aadhaar linking through the Income Tax e-filing website. In case you haven’t linked them yet, do so before the deadline to avoid any penalties.

Self-Instruct

Self-Instruct